.png)

Pencapaian ESG dari investasi operasional dengan pengaruh signifikan INA

89%

Memiliki Kebijakan ESG atau HSE terkait

0%

Kasus Fatalitas

4

topik ESG yang dipantau di seluruh portofolio

67%

Memiliki pengawasan ESG hingga tingkat dewan direksi

5,500+

Mendukung Pekerjaan

65%

Tenaga Kerja Wanita

Bagi INA, investasi yang bertanggung jawab adalah fondasi dari misi kami dalam membangun kekayaan nasional jangka panjang, sekaligus mendukung pembangunan yang inklusif dan berkelanjutan.

Kami mengintegrasikan prinsip Lingkungan, Sosial, dan Tata Kelola (ESG) ke dalam setiap tahap proses investasi kami, mulai dari uji tuntas (due dilligence) hingga kepemilikan aktif. Pendekatan ini membantu kami mengelola risiko, menciptakan nilai jangka panjang, serta selaras dengan tujuan pembangunan Indonesia dan standar keberlanjutan global.

Dengan berinvestasi secara bertanggung jawab, INA menciptakan dampak yang lebih besar, bukan sekadar imbal hasil.

Investasi kami mendorong efek pengganda ekonomi dan keuangan, mendukung penciptaan lapangan kerja, serta memperkuat ketahanan Indonesia di masa depan.

Di INA, pendekatan kami terhadap praktik berkelanjutan berlandaskan pada tiga pilar utama: Integrasi ESG, Kepemilikan Aktif dan Pengembangan Sektor Investasi Hijau

Di INA, pendekatan kami terhadap praktik berkelanjutan berlandaskan pada tiga pilar utama: Integrasi ESG, Kepemilikan Aktif dan Pengembangan Sektor Investasi Hijau

Integrasi ESG

> Pelajari Lebih Lanjut.svg)

Kepemilikan Aktif

> Pelajari Lebih Lanjut.svg)

Energi Hijau dan Sektor Blue Economy

> Pelajari Lebih Lanjut.png)

Kami berupaya mengintegrasikan pertimbangan ESG yang relevan dan berdampak di seluruh proses investasi, tidak hanya untuk mengelola risiko ESG secara lebih efektif, tetapi juga untuk mengoptimalkan peluang keberlanjutan dalam portfolio investasi kami.

Kami berupaya mengintegrasikan pertimbangan ESG yang relevan dan berdampak di seluruh proses investasi, tidak hanya untuk mengelola risiko ESG secara lebih efektif, tetapi juga untuk mengoptimalkan peluang keberlanjutan dalam portfolio investasi kami.

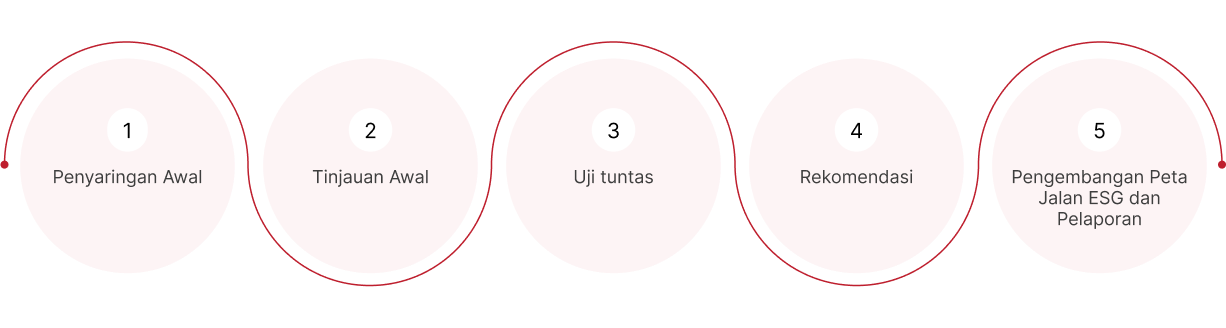

Penyaringan, Tinjauan Awal dan Uji tuntas ESG (1,2,3)

Penyaringan awal mengacu pada daftar pengecualian INA, diikuti oleh uji tuntas atau penilaian ESG untuk mengidentifikasi risiko material dan peluang nilai tambah bagi perusahaan target.

Rekomendasi ESG (4)

Rekomendasi ESG yang relevan dan berdampak dipertimbangkan dalam keputusan investasi dan diintegrasikan ke dalam dokumen transaksi sesuai kebutuhan.

Pengembangan Peta Jalan ESG dan Pelaporan (5)

INA berupaya bekerja sama dengan perusahaan portofolio untuk menetapkan peta jalan dan target ESG yang disesuaikan dengan struktur investasi dan kepemilikan. Kami berkomitmen untuk melaporkan implementasi ESG secara rutin guna memastikan transparansi dan memperkuat hubungan dengan pemangku kepentingan.

.png)

Area Fokus ESG Kami

Emisi GRK & polutan udara

.svg)

Manajemen energi

.svg)

Pengelolaan air

.svg)

Pengelolaan limbah

.svg)

Dampak Ekologis

.svg)

Praktik dan pelatihan tenaga kerja

.svg)

Kesehatan & keselamatan

.svg)

Keterlibatan, keragaman & inklusi

.svg)

Keterlibatan komunitas

.svg)

Tenaga kerja & pertumbuhan ekonomi

.svg)

Ketahanan model bisnis

.svg)

Etika bisnis & antikorupsi

Kami berupaya mengintegrasikan pertimbangan ESG yang relevan dan berdampak di seluruh proses investasi, tidak hanya untuk mengelola risiko ESG secara lebih efektif, tetapi juga untuk mengoptimalkan peluang keberlanjutan dalam portfolio investasi kami.

Di INA, kami berkomitmen untuk mengurangi jejak karbon melalui langkah-langkah nyata dan terukur. Sejak 2024, INA telah mulai menggunakan kendaraan listrik untuk mengurangi emisi dari konsumsi bahan bakar kendaraan operasional (Cakupan 1). Sejalan dengan upaya tersebut, INA telah mulai membeli Renewable Energy Certificate (REC) untuk mengimbangi emisi operasional Cakupan 2 kami pada 2023 dan 2024. Kami percaya bahwa pemantauan yang transparan dan aksi nyata dalam pengurangan emisi merupakan kunci dalam mendukung transisi menuju masa depan yang lebih hijau.

100%

dari emisi GRK Operasional Cakupan 2 yang diimbangi selama 2 tahun terkhir.

Kami mendorong terciptanya keragaman tenaga kerja dengan fokus pada kesetaraan peluang di semua tingkat. Target keberagaman kami mencerminkan komitmen berkelanjutan terhadap representasi yang inklusif dan setara.

40%+

Pegawai Perempuan – target yang telah kami capai secara konsisten dari tahun ke tahun.

45%

Perempuan di posisi manajerial – mencerminkan representasi yang kuat dalam jajaran kepemimpinan.

INA bekerja sama dengan perusahaan portofolio dalam mengelola risiko ESG, memperkuat tata kelola dan, memajukan praktik keberlanjutan. Pendekatan kami bersifat fleksibel dan disesuaikan dengan karakteristik tiap investasi, namun selalu berfokus pada isu isu material yang mendorong penciptaan nilai jangka panjang.

Fokus Utama

Tata Kelola Perusahaan

Kepatuhan terhadap prinsip-prinsip tata kelola yang baik, termasuk keberadaan kebijakan kode etik, kebijakan anti-suap dan anti-korupsi, serta sistem pelaporan pelanggaran.

.svg)

Pengawasan oleh Dewan Direktur

Keterlibatan Dewan Direktur dalam mengawasi dan mengelola isu ESG.

.svg)

Keberlanjutan

Pengembangan strategi dan rencana untuk mengelola isu-isu keberlanjutan secara efektif, seperti efisiensi energi, manajemen emisi gas rumah kaca, dan pengembangan sistem pelaporan pelanggaran.

.svg)

Sumber Daya Manusia

Keberadaan strategi dan rencana untuk membangun tenaga kerja yang berkualitas, beragam dan inklusif.

Sektor Jalan Tol

PT Rafflesia Investasi Indonesia (PT RII) merupakan platform jalan tol yang dibentuk oleh INA, Abu Dhabi Investment Authority (ADIA), dan APG Asset Management. PT RII mengelola empat ruas jalan tol strategis:

Sebagai entitas baru, PT RII telah memprioritaskan tata kelola yang baik; baik di tingkat platform maupun pada seluruh aset yang dikelola. Pada 2024, INA mengadopsi beberapa kebijakan utama, termasuk:

Kode Etik

Kebijakan Pihak Ketiga

Kebijakan Lingkungan, Sosial, dan Tata Kelola

Kebijakan Anti-suap dan Anti-Korupsi

Bersama INA, ADIA dan APG, PT RII turut mengembangkan Peta JalanKeberlanjutan serta Key Performance Indicators (KPI) yang berfokus pada:

Peningkatan efisiensi energi

Peningkatan pelatihan karyawan

Perbaikan sistem manajemen mutu

.png)

INA berkomitmen mendukung agenda iklim global dengan mengarahkan modal strategis ke sektor-sektor yang mendorong transisi Indonesia menuju ekonomi rendah karbon.

Strategi investasi hijau kami berfokus pada:

Transisi energi

Teknologi bersih

Natural capital dan blue economy